Even businesses with robust lead gen programs often fall short when it comes to retention. That’s painful in any business, but in the B2B sector, it’s especially unhappy news. On average, it costs seven times as much of a marketing investment to convert a new lead to a buyer than it is to earn repeat business from existing buyers. While some customer churn is inevitable, some of it is a product of spotty database management. Customer contact information that becomes unavailable or isolated in a dysfunctional database could lose you a valued client.

There’s a bright side to reducing customer churn with better data management. Just a small effort pays big dividends; lowering your churn rate by only 5 percent can increase profits dramatically. Depending on the length of your sales cycle and your average transaction size, you could see a jump of nearly 100 percent with just this small degree of change.

Why Customer Churn Happens

Sometimes, there’s little you can do about churn. Businesses relocate, repurpose themselves, or close without any input from you. To reduce churn, you first need to know more about how often it happens and why. A churn rate of 3 to 5 percent monthly is typical in many industries, but yours may have a higher or lower native churn rate. Aside from the reasons for leaving that are beyond your control, these factors are common in increasing customer loss:

-

Poor customer service

-

Insufficient onboarding and support

-

Lack of nurturing

-

Inefficient hand-off between marketing and sales

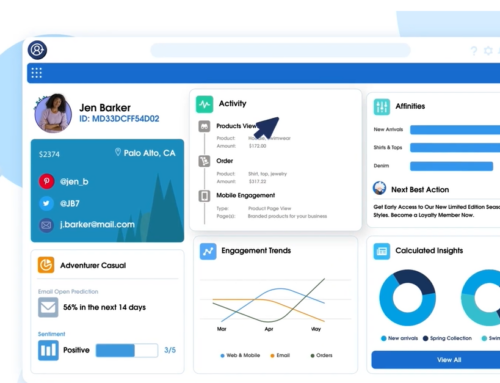

All of these churn causes can be mitigated with a centralized, integrated database. With complete information at their fingertips, customer service personnel spare leads lengthy service calls. From lead nurture to ongoing tech support, a centralized database has all a customer’s account information available. The exchange between marketing and sales is seamless with an integrated database.

Turning Data into Happiness

If poor service makes customers leave, stellar service encourages them to stay. The challenge here is to learn what customers want from their customer service, and that’s only answerable with sufficient data. A relational database can then analyze information and come up with aggregate data that shows you what makes your leads tick. Data analytics will show you why your customers leave and give you good advice about how to make them stay.

For example, let’s say you look at customer service records. Your marketing database management consultant sees that calls without a hand-off to another representative had a 32 percent churn rate, whereas calls that involved a transfer to a manager or other operator had an 84 percent churn. Your primary goal, then, might be to solve a customer’s problems with a single call and no transfers to a co-worker.

Tracking over Time

Comparing yourself against others in your industry is useful, but comparing your current churn rates with historical data speaks volumes about your organization’s ability to instill loyalty. Taking the data you already gather and using it as an integral part of your customer retention plan is a smart use of valuable information.

© Reach Marketing LLC 2017 All Rights Reserved.